The lenders’ lawsuit claims Brahmbhatt’s companies owe more than $500 million, the Wall Street Journal reported.$500 Million ka Fraud

1. Background

-

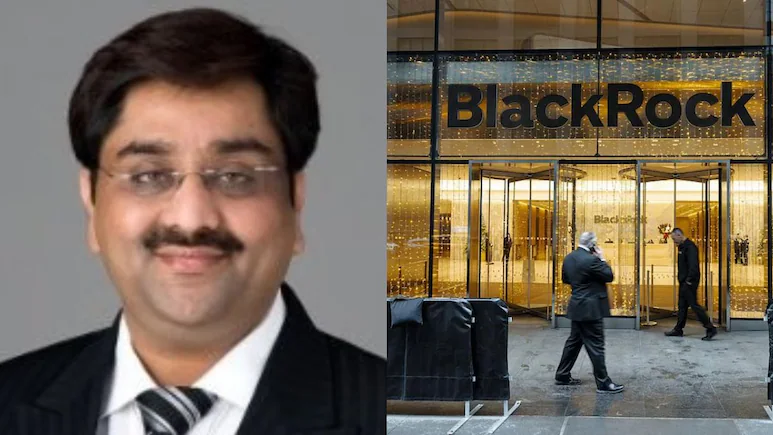

Bankim Brahmbhatt ek Indian-origin entrepreneur hai, jinhone telecom sector mein businesses banaye hain. India Today+2Hindustan Times+2

-

Unki companies, jaise Broadband Telecom aur Bridgevoice, telecom services aur connectivity infrastructure provide karte the. Hindustan Times+2The Tribune+2

-

Unka group, Bankai Group, unki identity had declared as president / CEO. The Tribune+2India Today+2

2. Fraud ke allegations

-

Lenders ka accusation hai ki unhone fake invoices aur bogus accounts receivable create kiye. Ye receivables collateral bana ke bada loans liye gaye. The Financial Express+2The New Indian Express+2

-

Collateral ke roop mein, unhone claims kiye they have revenue from customers, lekin investigation mein pata chala hai ki many customer contracts aur invoices fake hain. Hindustan Times+2The Economic Times+2

-

Emails aur customer addresses bhi suspicious nikle — kuch email domains asli telecom companies jaisa lag rahe the, lekin wo fake domains the. The Wall Street Journal+2The New Indian Express+2

-

Court documents ke mutabik, pichle do saalon ke saare customer emails bogus the, aur kuch contracts 2018 se forged the. The Wall Street Journal+2Hindustan Times+2

3. Loans aur lenders ka role

-

HPS Investment Partners, jo ab BlackRock ke under hai, ne September 2020 se loans diye. The Wall Street Journal+2India Today+2

-

Unhone exposure ko badhaya: early 2021 tak ~ USD 385 million, aur August 2024 tak ~ USD 430 million. The Wall Street Journal+2The Financial Express+2

-

BNP Paribas bhi involved tha, jinhone lagbhag half funding provide ki thi. The Financial Express+2The New Indian Express+2

4. Discovery aur collapse

-

July 2025 mein, HPS ke ek employee ne irregularities notice ki: email addresses fake domains se the. The Wall Street Journal+2Hindustan Times+2

-

Jab unhone confirm karne ki koshish ki, to companies ke offices locked thi, aur koi staff nahi dikh raha tha. The Wall Street Journal+1

-

August 2025 mein companies ne bankruptcy file ki: unhone Chapter 11 protection li, jisse wo re-organization (dono business & personal) ke liye legal protection le sake. The New Indian Express+2India Today+2

-

Waise hi, Bankim ne bhi personal bankruptcy file ki. India Today+2The New Indian Express+2

5. Whereabouts aur legal situation

-

Unke New York ke Garden City offices vacated mile, aur unke listed residence pe luxury cars parked thi, par koi activity nahi mil rahi thi. The Wall Street Journal+2The Tribune+2

-

Lenders ka kehna hai ki assets (jo collateral banaye gaye the) India aur Mauritius mein transfer ho gaye. The Wall Street Journal+2The Financial Express+2

-

Unke lawyer ne allegations ko challenge kiya hai, but abhi multiple investigations chal rahe hain. Hindustan Times+2The Tribune+2

6. Lessons aur implications

-

Ye case ek warning hai ki private credit / asset-based financing mein due diligence bahut zaroori hai. Agar collateral properly verify na ho, to huge risks ho sakte hain.

-

Fraud detection tools jaise email domain verification, contract authenticity checks, customer confirmation — in sab ka role strong hona chahiye.

-

Regulators aur investors ko dikkat ye hai ki kuch loans financial statements par based hote hai jisme assumptions zyada hoti hain.

-

Yeh case investors ke trust ko fragile bana sakta hai, aur as a content creator / blogger, isko highlight karna useful hai — taaki readers aware ho sakein risk factors.

[…] Read Also –> $500 Million ka Fraud: Indian-origin […]

[…] Read Also –> $500 Million ka Fraud: Indian-origin […]